Microsoft Copilot usage statistics in 2026 reflect how frequently the tool is used in practice, rather than how heavily it is promoted. Because Copilot is built directly into Windows, Microsoft 365, mobile apps, and web interfaces, usage data provides a more accurate picture of real adoption than launch announcements or feature releases.

In 2026, Microsoft Copilot is used mainly inside products people already rely on every day. This changes how adoption should be measured. Web traffic reflects awareness, and downloads show initial interest, but neither indicates whether Copilot becomes part of daily work. Active user data is the clearest signal of repeat, practical use.

Because Microsoft does not publish a single unified usage metric, the latest Microsoft Copilot usage statistics in 2026 are best understood by combining several indicators: active users across platforms, download trends, and traffic to Copilot’s web interface. These adoption metrics answer different questions and only make sense when viewed together.

- 33 million active users across Windows, Microsoft 365, web, and mobile.

- 36+ million total downloads since launch (lifetime).

- Microsoft 365 apps drive most repeat, work-focused usage.

- Copilot web traffic declined ~17% QoQ (Oct–Dec 2025), signaling a shift to embedded use.

- ~20 million weekly users interact with Copilot inside Microsoft 365 apps.

Our Methodology

Microsoft does not publish a single unified Copilot usage metric. To provide an accurate picture of adoption, we combine multiple data sources and clearly separate what each metric represents.

What we analyze:

- Official Microsoft disclosures (News, Learn, product updates)

- Enterprise reporting snapshots (active licenses, weekly users)

- Third-party traffic analytics (Semrush, Similarweb)

- App store install indicators (Google Play badges, cumulative download estimates)

What we prioritize:

Active users and in-app engagement over vanity metrics like downloads or web visits. Because Copilot is embedded into Windows and Microsoft 365, real adoption is best measured by prompt activity and repeat usage — not page views.

How we treat estimates:

Where Microsoft does not publish monthly data, we use third-party aggregates and clearly label them as estimates. No single number is treated as definitive; adoption is evaluated across surfaces (Windows, M365, web, mobile) to avoid overstatement.

This multi-source approach provides a balanced, realistic view of Copilot usage as of January 2026.

Microsoft Copilot Key Facts

Microsoft Copilot is an AI assistant built directly into Microsoft tools that people already use every day. It helps Microsoft users write content, analyze data, summarize documents, and manage information inside Windows and Microsoft 365 apps.

Because Copilot works within familiar environments, users do not need to change their workflows — which is why Microsoft Copilot statistics based on real usage matter more than feature lists.

| Fact | Detail |

| Active Copilot users | Microsoft Copilot had 33 million active users across Windows, apps, and web surfaces. (Business of Apps) |

| Total Copilot downloads | Copilot has been downloaded 36 million times since its launch. (Business of Apps) |

| Initial launch date | Copilot launched on 1 November 2023. (Business of Apps) |

| Platforms supported | Copilot runs on Windows, in Microsoft 365 apps, web, and mobile. (Business of Apps) |

| Usage sample analyzed | Microsoft analyzed 37.5 million Copilot conversations in its 2025 usage report. (Microsoft News) |

| Copilot in Microsoft 365 | Integrated into Word, Excel, Outlook, and Teams for productivity use cases. (Business of Apps) |

| Enterprise usage prevalence | Copilot is in use by many Fortune 500 companies. (Microsoft News) |

| Active usage reporting | Admin dashboards show active users and prompts over defined timeframes. (Microsoft Learn) |

| Copilot chat prompts tracked | Reports can include total prompts submitted by users in a period. (Microsoft Learn) |

| Global reach | Copilot availability extends to multiple global regions (varies by market). |

| Language coverage | Copilot supports multiple languages depending on the platform. |

| Enterprise deployments | Organizations track adoption with admin and analytics tools. (Microsoft Learn) |

Together, these facts show how Microsoft Copilot has moved beyond a standalone AI tool and become part of everyday work inside Microsoft’s core products.

1. Microsoft Copilot Web Visits and Traffic Trends

Web visits measure how often users land on the copilot.microsoft.com domain. This does not reflect the full scope of Copilot usage data, since many users interact with Copilot directly inside Windows or Microsoft 365 applications. However, web traffic still provides a useful snapshot of awareness and discovery outside embedded environments — similar to how an AI SEO audit helps capture early-stage visibility and interest before deeper, product-level engagement is measured.

Visits rise when new features or publicity bring attention. Sustained value and retention tend to show up first in direct usage inside apps, not on the public web domain.

What “Web Visits” Measures

- Discovery and interest: How many people actively search for and visit the public Copilot page.

- Referral sources: Tell us where people come from (direct, search, or links).

- Trend signals: Rising visits can indicate growing awareness; falling visits may suggest users rely more on embedded access (Windows, M365) than the web page itself.

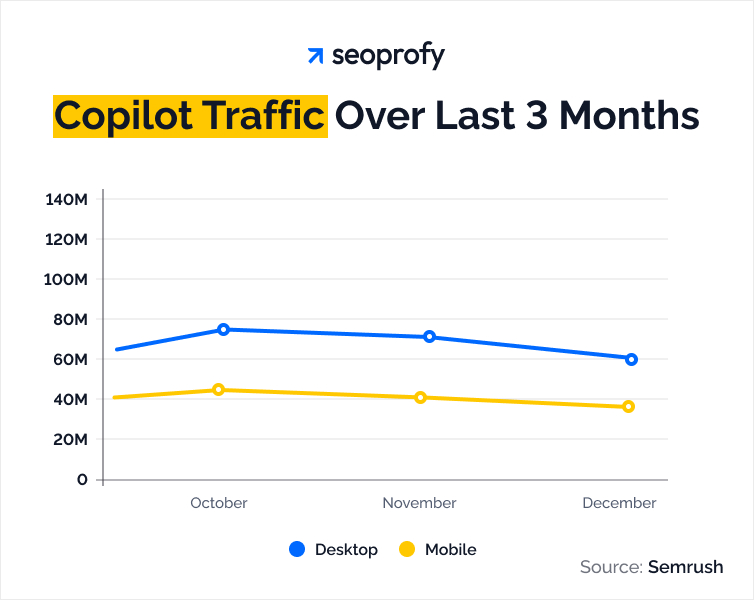

Monthly Copilot Web Visits

| Month | Web Visits (approx.) |

| Oct 2025 | 117.2 M |

| Nov 2025 | 110.3 M |

| Dec 2025 | 96.6 M |

Source: Semrush Traffic Analytics — copilot.microsoft.com web traffic overview.

Trend takeaway: Web traffic to Copilot’s public interface has shown a decline over the last quarter, with roughly a 17% drop from October to December 2025. This suggests either reduced direct browsing interest or a shift toward usage through apps and embedded interfaces rather than the web page itself.

Why This Matters for Awareness vs Retention

Awareness (web visits):

- These numbers reflect people learning about Copilot or returning via their browser.

- High web visits can indicate strong interest or visibility from search and direct visits.

Retention (active usage inside products):

- Actual ongoing use often happens inside Windows, Microsoft 365 apps, or other embedded experiences not captured by web traffic.

- A decline in visits does not necessarily mean adoption is declining — it can mean users are skipping the web and going straight to where Copilot is built into their workflows.

As Copilot and similar tools become part of everyday work, brands increasingly compete for visibility inside AI-generated answers, summaries, and recommendations rather than traditional search results. This shift is driving demand for AI SEO and newer disciplines such as Generative Engine Optimization (GEO) and Answer Engine Optimization, or AEO.

Optimizing content for LLM citations and AI-generated answers requires a different approach than traditional SEO. Instead of focusing primarily on rankings and clicks, it prioritizes authority, clear structure, and factual clarity — the signals large language models use when deciding which sources to cite or rely on.

2. Microsoft Copilot Downloads and Release-Driven Trends

“Downloads” in this context refers to times users installed the Copilot app or feature from app stores and distribution channels (mobile stores, Microsoft Store, or bundled installer experiences). These figures are not the same as active users (people who use Copilot regularly), but they show interest and trial intent, particularly around major releases or platform expansions.

Why Releases Matter

Every time Microsoft expanded Copilot’s reach — to new platforms, major feature sets, or automatic installs — interest typically spiked. Activity around those dates often correlates with increased downloads or attention in analytics tools, even if exact monthly totals aren’t published officially.

Key Releases That Likely Influenced Downloads

- September 26, 2023: Windows Copilot becomes broadly available to users outside Insider builds, bringing the AI assistant to the Windows taskbar. (Microsoft)

- November 1, 2023: Microsoft 365 Copilot general availability for enterprise customers, marking the first major push into productivity apps. (The official Microsoft blog)

- Throughout 2025: Ongoing improvements to Copilot features across Windows and Microsoft 365 likely sustained interest (visual/video features, workflows). (Microsoft Learn)

- October 2025: Microsoft begins automatic installation of the Copilot app on Microsoft 365 clients, increasing distribution (though not reported directly as “downloads” this expands the installed base. (TechRadar)

Estimated Monthly Downloads (Third-Party Approx.)

| Month | Estimated Downloads (App Store/Analytics) |

| January 2024 | ~4.2 M estimated* |

| March 2024 | ~5.0 M estimated* |

| December 2024 | ~3.2 M estimated* |

| 2025 (monthly) | Not publicly reported |

*Sources such as ElectroIQ compile estimates from app analytics and store trends. These are not official Microsoft figures but serve as rough indicators of interest patterns.

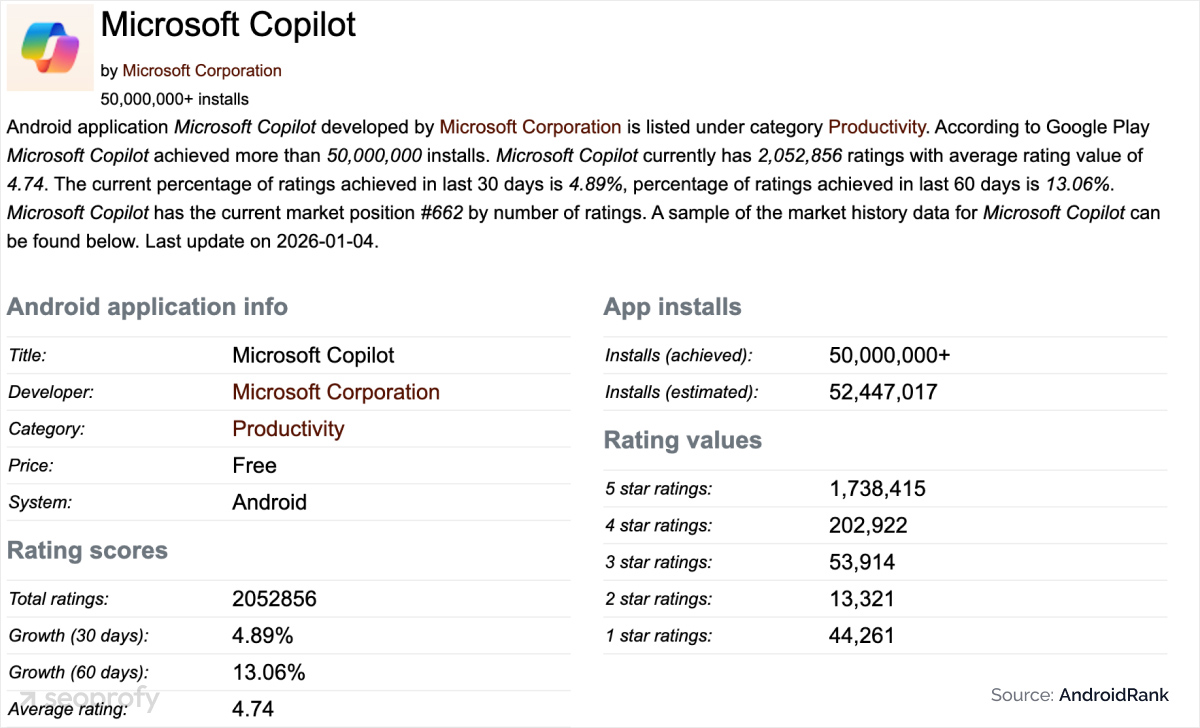

Download Scale and Cumulative Installs (2025)

Microsoft does not publish official monthly download figures for Copilot. As a result, download data comes from third-party app analytics and cumulative install reports, which are useful for spotting interest and distribution trends, but not for measuring active use.

While monthly data is unavailable for 2025, cumulative and store-level indicators show overall scale:

- 36M+ total downloads since launch (all platforms, cumulative). Business of Apps

- 50M+ Android installs (lifetime) shown via Google Play install badge. AndroidRank / Google Play

Apple does not publish public install counts for iOS apps.

Peaks, Seasonality, and Release Correlation

Early-2024 peaks

Estimated downloads peaked in early 2024, which aligns with:

- Broader Copilot availability beyond previews

- Increased media coverage

- Early mobile app adoption

Late-2024 decline

Lower estimated downloads toward the end of 2024 likely reflect:

- Reduced curiosity after initial testing;

- Users are shifting from downloading apps to using Copilot inside existing Microsoft tools.

2025 shift away from downloads

In 2025, Copilot expanded further inside Windows and Microsoft 365. Many users began accessing it without downloading a separate app, through:

- OS-level integrations

- Microsoft 365 licenses

- Automatic or prompted installs

This reduced the relevance of traditional “monthly downloads” as an adoption metric.

3. Microsoft Copilot Active Users and Active User Base

Understanding active users is essential because it shows how many people actually use Copilot regularly, rather than just installing it or visiting a landing page. Active usage indicates whether Copilot is embedded into daily workflows inside Microsoft products like Windows and Microsoft 365, or whether it is mainly being tested without long-term adoption.

For AI SEO services, this distinction matters at an industry level, not because Copilot is an SEO tool, but because it reflects how users interact with AI systems once they are built directly into products. As AI becomes part of everyday workflows, visibility increasingly depends on how AI systems surface and rely on information, not on installation counts or page visits.

How “Active” is Measured

In Microsoft’s usage reporting (e.g., the Microsoft 365 Copilot admin center), active users are counted based on user-initiated Copilot actions, such as submitting a prompt or interacting with Copilot features, within a defined period (e.g., 7, 30, or 90 days). That’s different from merely having a license enabled; it reflects real engagement.

For broader Copilot adoption reporting, third-party aggregators combine product usage from Windows, web, and apps to estimate an active user base across surfaces.

Active User Numbers: What We Know

| Metric | Active Users | Date |

| Combined Copilot active users (all surfaces) | 33 million | 2025 (latest aggregated data) |

| Copilot chat weekly users (M365 apps) | ~20 million | mid-2025 |

| Enterprise-licensed active Copilot users | ~8 million | August 2025 (Microsoft 365 Copilot only) |

What do these numbers of the active user base of Copilot mean

- 33 million active users reflect Copilot use across multiple surfaces (Windows, web, apps) — a broad adoption estimate.

- ~20 million weekly users of Copilot Chat inside Microsoft 365 apps show deep engagement among people working in productivity contexts, mid-2025.

- ~8 million active licences in Microsoft 365 Copilot indicates slower enterprise rollout in some segments as of mid-2025.

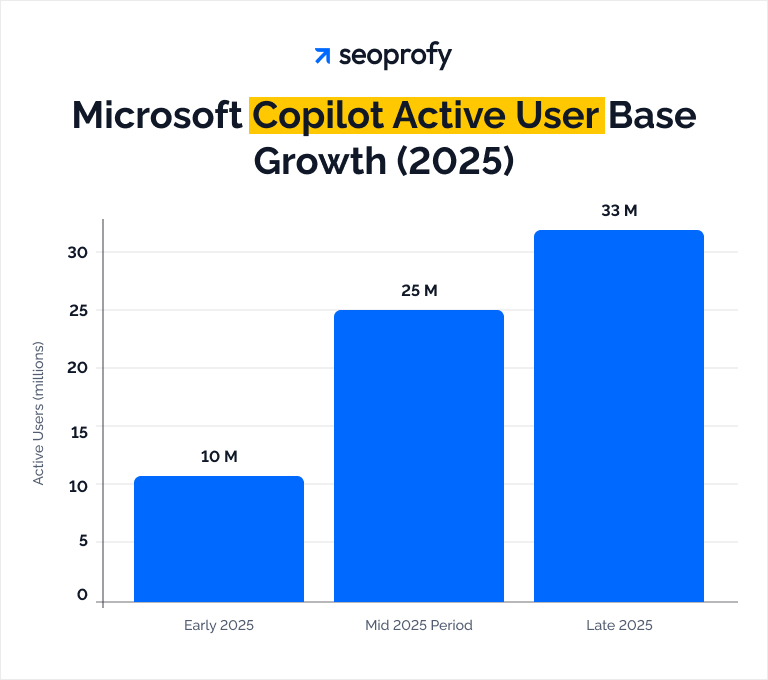

Active Users Over Time (Trend Chart)

Below is a simple trend overview based on the available snapshots:

- Early 2025: Active enterprise Copilot licences began rolling out widely.

- Mid-2025: Broader active use in Microsoft 365 showed weekly engagement.

- Late 2025: Estimated total active Microsoft Copilot users across surfaces approached ~33 million. (Data Studios)

Precise monthly data isn’t publicly reported by Microsoft; these points reflect the best available aggregates.

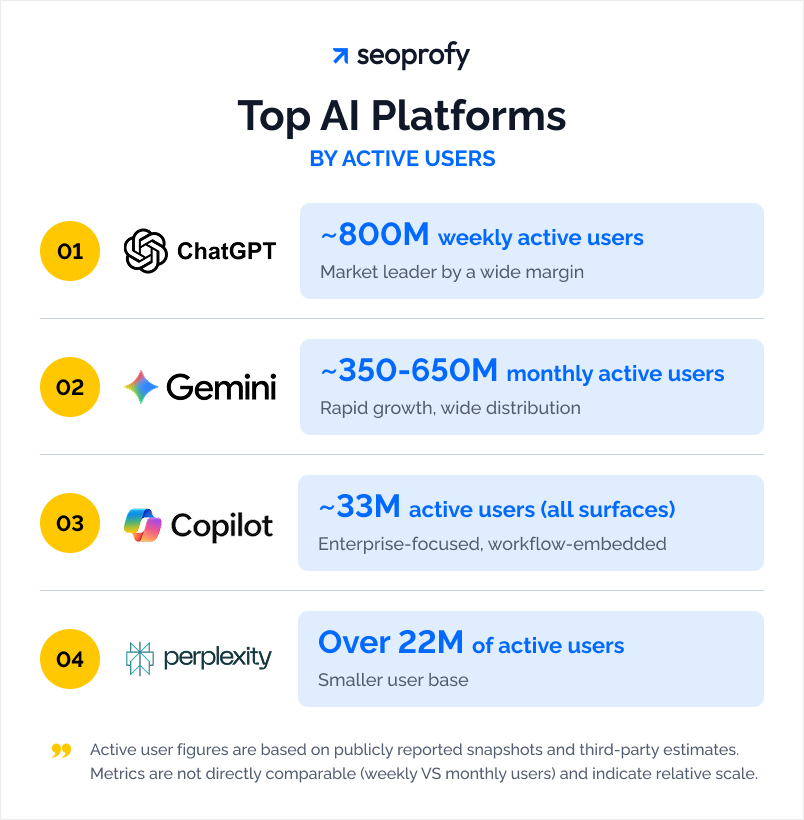

4. Copilot vs Other Major AI Platforms (Users & Market Share)

For context on where Copilot stands relative to broader AI usage:

| Platform | Active Users | Market Position |

| ChatGPT | ~800M weekly active users | Market leader by a wide margin |

| Google Gemini | ~350–650M monthly active users | Rapid growth, high distribution |

| Microsoft Copilot | ~33M active users (all surfaces) | Lower user base, enterprise-focused |

| Perplexity AI | Over 22M of active users | Minor share compared to the big three |

Market share context: Third-party AI market rankings estimate ChatGPT and Gemini dominate global usage, while Copilot captures a smaller slice focused on productivity workflows rather than general chat usage.

5. Active Users by Surface: Where Microsoft Copilot Is Used

Microsoft Copilot is not used in one place. It’s accessed through several surfaces, each serving a different type of task. Understanding these surfaces helps explain why some usage never shows up in web or app metrics.

Windows (Taskbar and OS Integration)

Copilot on Windows is accessed directly from the taskbar or system interface. This surface is used for quick, contextual actions: asking questions, summarizing content, or triggering simple tasks without opening a separate app. Because it’s built into the operating system, usage here often feels invisible — but frequent. Many users rely on this entry point for fast help during everyday work.

Microsoft 365 (In-App Usage)

Inside Microsoft 365 apps like Word, Excel, Outlook, PowerPoint, and Teams, Copilot supports longer, work-focused tasks. This includes drafting text, analyzing spreadsheets, summarizing emails, or preparing meeting notes. Usage on this surface is typically deeper and more repeat-driven, especially among professionals who spend most of their day inside these tools.

Web Experience

The web version of Copilot is mainly used for discovery, exploration, and one-off tasks. It often attracts new users or those who want to test Copilot without committing to app or OS usage. Web activity reflects awareness more than long-term habit, especially as many regular users move to embedded surfaces.

Apps (iOS and Android)

On mobile and laptops, Copilot is used for short, on-the-go interactions. This includes quick questions, follow-ups, or reviewing summaries outside the main work setup. Mobile usage tends to be lighter and more situational compared to desktop and in-app use.

Microsoft Copilot Usage by Surface

| Surface | Typical Usage Pattern | What’s Best For |

| Windows | Frequent, lightweight interactions | Quick help, system-level access |

| Microsoft 365 | Deep, repeated usage | Writing, analysis, meetings |

| Web | Occasional, exploratory use | Discovery, testing |

| Mobile | Short, situational use | On-the-go tasks |

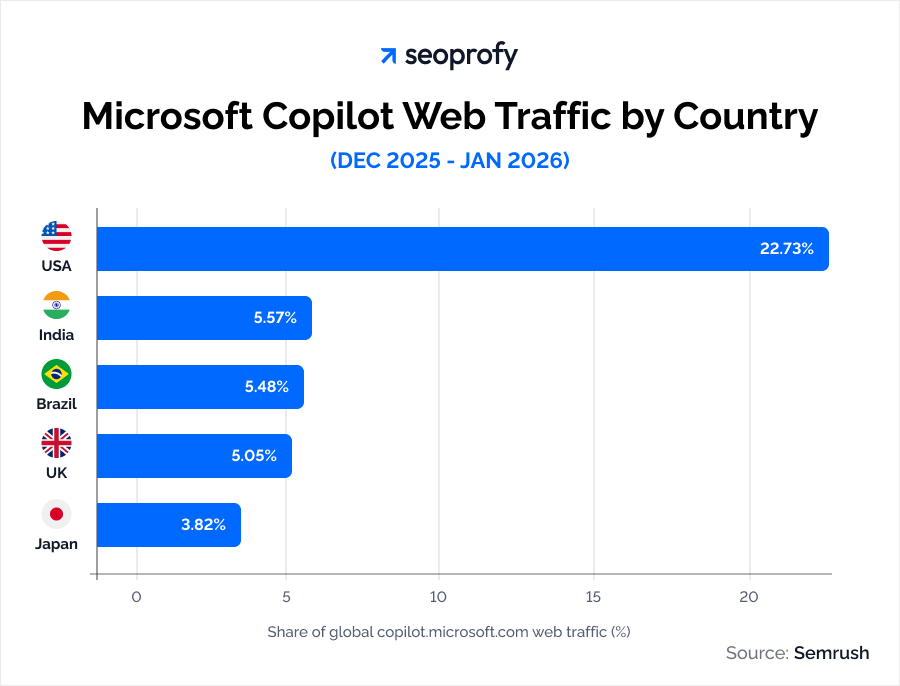

Users by Region (Based on Website Traffic)

Microsoft Copilot’s regional audience can be measured most reliably through copilot.microsoft.com web traffic, which reflects discovery, testing, and non-embedded usage. According to Similarweb data (December 2025–January 2026), Copilot’s web audience is concentrated in a small number of large markets.

Top countries by share of global website traffic:

- United States: 22.73% of total traffic (~296.15M visits)

Desktop accounts for 59.41%, mobile 40.59%, indicating strong work-related usage patterns. - India: 5.57% (~72.57M visits)

Traffic is relatively balanced between desktop (52.84%) and mobile (47.16%), suggesting both professional and exploratory use. - Brazil: 5.48% (~71.36M visits)

Mobile usage slightly exceeds desktop (52.1% vs 47.9%), pointing to broader consumer access alongside work usage. - United Kingdom: 5.05% (~65.81M visits)

Desktop-heavy traffic (54.89%) aligns with enterprise and office-based use. - Japan: 3.82% (~49.82M visits)

Strongly desktop-dominant (72.96%), consistent with corporate and professional environments.

Source: Semrush — copilot.microsoft.com Website Traffic by Country, Dec 2025–Jan 2026

Users by Gender

Microsoft does not publish gender usage counts for Copilot. There is research on generative AI that shows a gender gap in workplace use: in one study, women were 16 percentage points less likely than men to use ChatGPT for job tasks, even among workers in the same roles.

Professional services research from Deloitte reported that in the U.S., women’s adoption of generative AI was roughly half that of men in 2023, and although the gap narrowed in 2024, it persisted. These figures describe broad AI tool usage patterns and should not be assumed to apply directly to Copilot until such data is published.

6. Copilot Usage Statistics — Engagement and Behavior

Based on survey results and 360-degree diary study entries, Microsoft identified the most common and valuable Copilot tasks.

How Often People Use Copilot

In a mixed-methods study of 125 Microsoft interns, Copilot showed strong repeat usage once introduced into daily work:

- 86% of participants reported using Copilot daily for at least one task

New-employee-Copilot-usage - Higher usage frequency correlated with:

- more favorable attitudes toward Copilot

- stronger desire to continue using it in future roles

New-employee-Copilot-usage.

This indicates Copilot is not treated as a one-off tool, but becomes part of regular workflows once adopted.

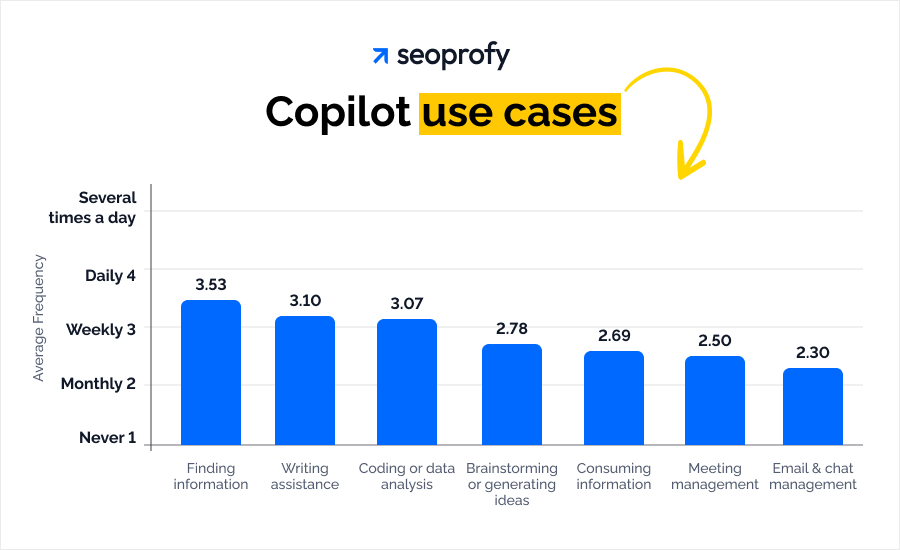

Top Copilot Use Cases (Ranked)

| Rank | Use Case | Evidence |

| 1 | Finding information | Most frequent survey + diary entries |

| 2 | Writing assistance | High survey frequency |

| 3 | Coding / data analysis | High diary submission volume |

| 4 | Brainstorming ideas | Consistent mid-frequency use |

| 5 | Summarizing content | Usage increased over time |

Use Case Frequency (Survey Data)

Average self-reported frequency (scale from Never → Several times a day) shows how Copilot fits into day-to-day work, according to their surveys:

User Intent: Why People Use Copilot

Diary study analysis shows what users are trying to achieve, not just what tasks they run.

Primary user goals:

| Goal | Share of Diary Entries |

| Learning & understanding information | 46% |

| Drafting or refining deliverables | 34% |

| Preparing & catching up | 11% |

| Showcasing professional impact | 4% |

| Communication support | 4% |

Source: New-employee-Copilot-usage

This confirms Copilot is used primarily as a learning and productivity accelerator, not just a content generator.

Device-Based Behavior (Strong, Unique Insight)

Microsoft Copilot usage varies by device: mobile is used mainly for personal, health-related questions throughout the day, while desktop usage concentrates during business hours and focuses on work, career, and technology tasks.

Time-of-Day & Weekly Patterns

Copilot usage follows clear time-based patterns. Programming and work-related queries peak on weekdays, while entertainment and gaming questions rise on weekends. Late-night usage skews toward personal and reflective topics.

Repeat Usage Patterns Over Time

Microsoft Copilot usage changes as users become more familiar with their environment:

- Information retrieval remains the most common use throughout

- Summarization and internal knowledge learning increase steadily over time

- New employees gradually use Copilot more for:

- Understanding company norms

- Learning team structures

- Consuming internal documentation.

Copilot is mainly used for everyday tasks that people repeat often, such as finding information, writing content, and helping with code. Once embedded into work tools, Copilot shifts from experimentation to habit, especially for learning, summarization, and getting “unstuck” on real tasks.

7. Microsoft Copilot Usage by Industry

Microsoft does not publish numeric Copilot usage by industry. However, official Microsoft scenario libraries and training materials show where Copilot is actively deployed, providing reliable proxies for industry usage.

Documented Industry Use Cases

- Manufacturing: Copilot supports operations, product design, and resource planning. (Microsoft Scenario Library (Manufacturing))

- Retail: Used for merchandising analysis, inventory forecasting, and operational insights. (Microsoft Scenario Library (Retail))

- Information Technology: Applied to helpdesk workflows, application usage analysis, and internal reporting. (Microsoft Scenario Library (IT))

- Business Functions Across Industries: Microsoft documents Copilot use cases for executives, sales, marketing, finance, HR, and operations, indicating cross-industry adoption. (Microsoft Copilot use-case learning paths)

Copilot is positioned as a general enterprise productivity tool, with documented usage spanning manufacturing, retail, IT, and core business functions rather than a single industry vertical.

Microsoft Copilot Trends in 2026

Copilot is now deeply embedded in Microsoft tools like Word, Excel, Outlook, and Teams, enabling users to complete tasks without leaving their workflows. Continued updates improve context awareness and usability.

Expanded agent features, including Agent Mode and Office Agent, allow Copilot to manage multi-step tasks, analyze data, and produce ready-to-use outputs across apps.

Usage differs by context: desktop activity focuses on work tasks during business hours, while mobile use skews more personal. The launch of an Agent Store supports enterprise adoption with role-specific, customizable agents.

Although Copilot trails some rivals in standalone consumer usage, its integration across Windows and Microsoft 365 gives it a strong enterprise advantage. In 2026, Copilot will have become a built-in productivity layer rather than an experimental add-on.