SEO for insurance brokers focuses on attracting local clients searching for coverage. It includes targeting location-based keywords, building practical content, optimizing local listings, improving site performance, strengthening authority with backlinks, and maintaining a technically reliable site to turn searches into qualified policy leads.

Based on our team’s experience, this niche has distinct challenges, which is why we felt it was important to explain marketing strategies that actually bring insurance broker websites to the top of search results and help them generate traffic and leads. If you want to get the most out of search, this article shows you how.

- Insurance broker SEO in 2026 starts with local intent: visibility depends on location data, positive reviews, and clear service relevance at the moment of search.

- AI and answer-based search favor well-structured content that explains insurance decisions, coverage scenarios, and real use cases in plain language.

- High-performing sites rely on deep service pages, so each insurance type is mapped to its own demand and queries.

- Reviews, licenses, experts, and case studies work together as ranking and conversion inputs.

- SEO for insurance company delivers value when it is tracked through leads, cost per lead, revenue contribution, and SEO ROI, then adjusted based on the results acquired.

What Is SEO for Insurance Brokers?

SEO for insurance companies is a way to make sure your brokerage shows up when people actively research insurance options in your area. It helps your site appear for searches tied to real user intent, such as policy comparisons, coverage questions, and broker discovery. This allows brokers to compete in local search results even when large insurance providers dominate paid ads.

Why invest in SEO for insurance brokers?

- Increase exposure in local and regional search results.

- Reach prospects who are already evaluating insurance options.

- Compete with national providers without matching their ad spend.

- Build a long-term source of inbound leads.

Why Insurance Brokers Need SEO More Than Ever

Search optimization is a strong approach for insurance brokers. It can generate traffic, leads, brand visibility, and other marketing benefits, leading to overall business growth, all without constant dependence on paid advertising. Here are the main reasons SEO matters today:

- Growing competition: More players target the same relevant keywords, so insurance agent SEO decides who appears in search results and who gets ignored.

- Local decision-making: Insurance is a geo-targeted service, and local SEO determines which brokers appear when potential clients search for options nearby.

- Trust and credibility: Local search rankings, organic visibility, reviews, and informational content influence which brokers are considered legitimate and reliable.

- Long-term demand capture: Search optimization allows brokers to stay visible throughout research, comparison, and decision stages.

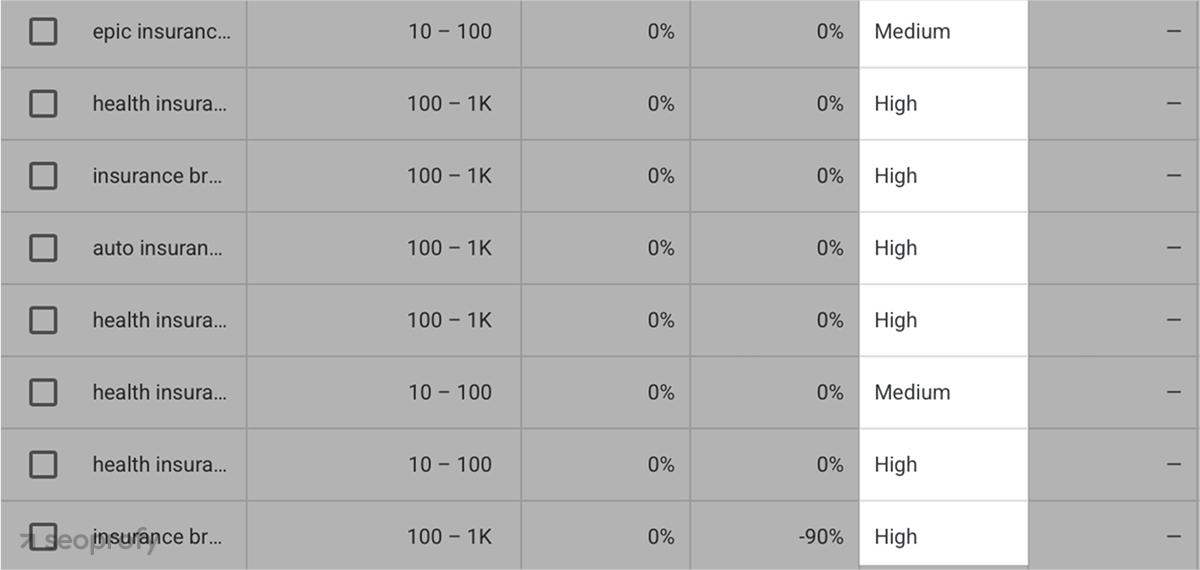

Moreover, paid search (PPC) adds cost pressure. If you run a quick keyword research in Google Ads, you’ll immediately see how expensive insurance-related terms are due to intense competition.

For example, the top-of-page bid for “health insurance broker New York” is around $35 per click now. This is a single visit with no guarantee of conversion. Without strict control, a few low-quality clicks can drain a monthly ad budget in one day. Insurance website SEO takes longer to build, but once established, it generates leads without paying for each click and gives brokers predictable control over acquisition costs.

Key SEO Strategies for Insurance Brokers in 2026

AI-driven search has once again changed how search engines rank content and distribute traffic. As a result, brokers have to rethink their SEO strategies and update how they approach search visibility and lead generation. Below is a forward-looking overview of the SEO tactics that will matter most for insurance brokers in 2026, based on current market trends and what top competitors are already doing right.

Win Local Visibility Beyond Google Search

Local visibility no longer lives only inside Google Maps. Brokers now show up, or don’t, inside AI-generated answers, voice results, and local recommendation layers built on Google Business Profile listings, business data, reviews, and consistency signals. To control this visibility, brokers need to manage the inputs these systems pull from:

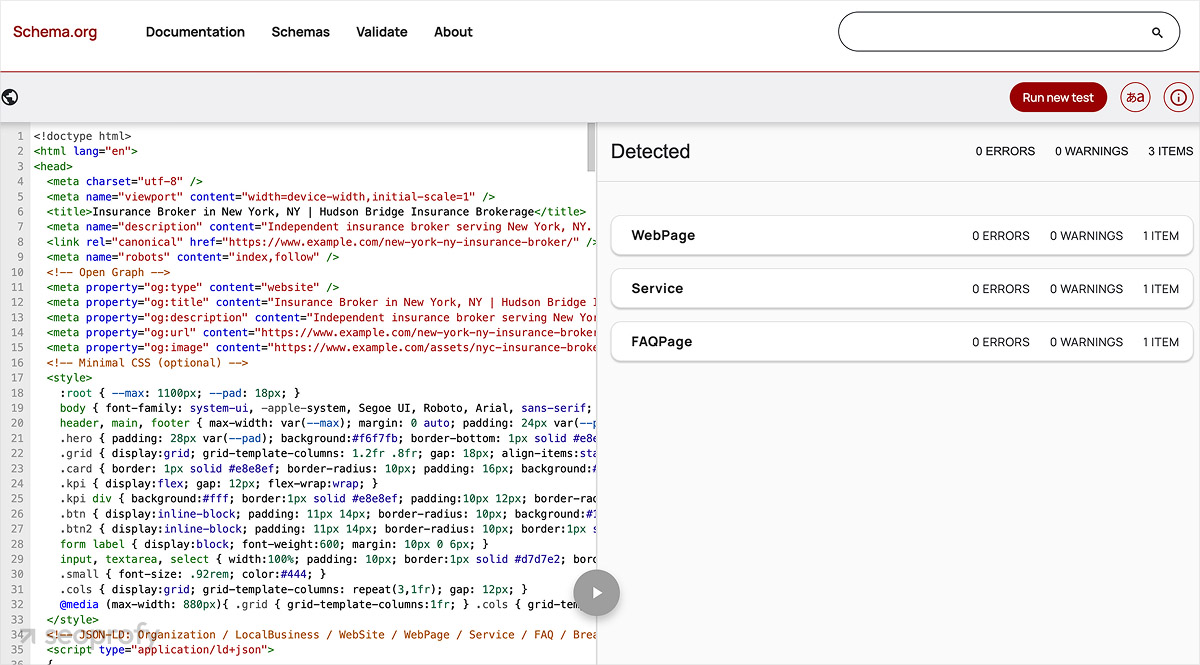

- Structured data (schema) to clearly define locations, services, and business entities.

- Review signals such as volume, freshness, and sentiment.

- Listing consistency across directories to avoid conflicting location data.

- Entity clarity around services, categories, and service areas.

- Location-specific pages that reinforce relevance beyond map results.

Optimize for AI, LLMs, and Answer-Based Search

AI systems learn what your business is by reading and comparing your content across the web. For insurance brokers, this means on-page SEO shifts slightly, and copy must clearly explain expertise, services, and intent in a format machines can parse and reuse.

Here’s how you structure content for AI SEO:

- Clear explanations: Pages should answer specific insurance questions in plain language and show expert framing.

- FAQ-style sections: Well-structured questions and direct answers help AI extract usable responses and your pages rank in AI Overviews.

- Strong topical focus: Each page should cover one insurance topic deeply instead of mixing multiple services.

- Consistent terminology: The same terms for products, services, and coverage types across all pages help AI connect the dots.

When content is structured this way, AI systems can confidently associate your business with insurance expertise and surface it in answers, voice results, and zero-click experiences.

Build Deep Service Pages, Not Generic Ones

Service pages need the most attention and depth on the site. Search engines expect a clear structure, and potential customers expect answers that match how they choose insurance. Here’s what to do and what to avoid:

|

Do |

Example |

Don’t |

| One service per page | Auto, home, life, and commercial insurance each have a dedicated page | One generic “Our Insurance Services” page |

| Intent-driven structure | Pages reflect how users compare coverage, pricing, and options | Vague descriptions without decision context |

| Real decision context | Strong content marketing: use cases, exclusions, and common questions are addressed | Marketing copy that avoids specifics or content generated through dedicated SEO tools |

| Clear separation | Services are clearly split to avoid overlap | Multiple services are mixed on the same page |

| Focused internal linking | Pages link logically to related content | Links coming from random local directories that blur topical relevance |

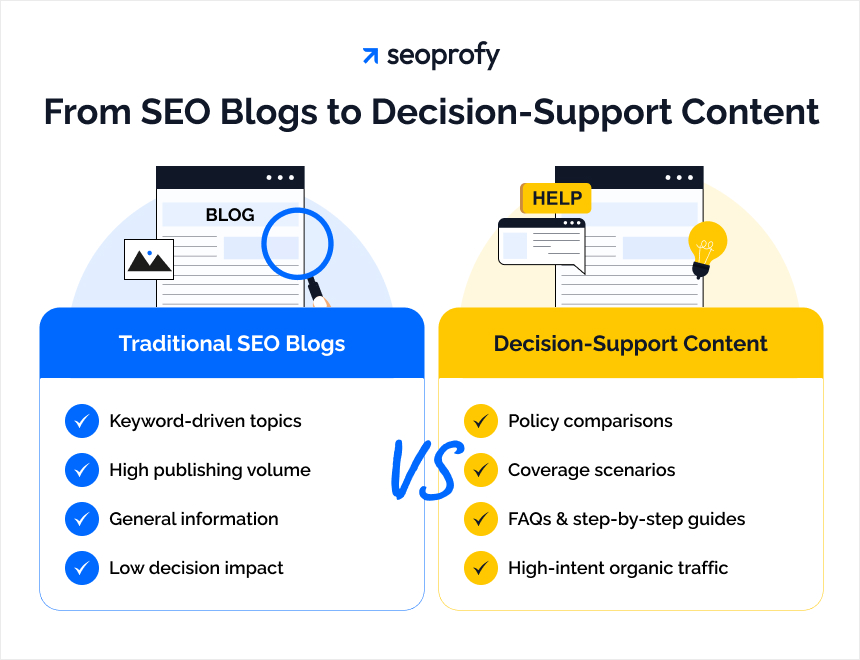

Shift Content from “SEO Blogs” to Decision-Support Content

Keyword-driven blog posts are easy to produce, but they rarely help people choose insurance. Most users arrive with real questions. They compare options, weigh risks, and try to understand what actually fits their situation.

That’s why content needs to sit closer to the decision itself. Comparisons between policies, coverage scenarios, FAQs, and step-by-step guides perform better because they answer the exact questions people have before contacting a broker. Strong SEO content follows this logic.

Such pages consistently bring the highest-intent organic traffic growth. When this approach is applied across services and use cases, it becomes an SEO content strategy built around real demand rather than publishing volume.

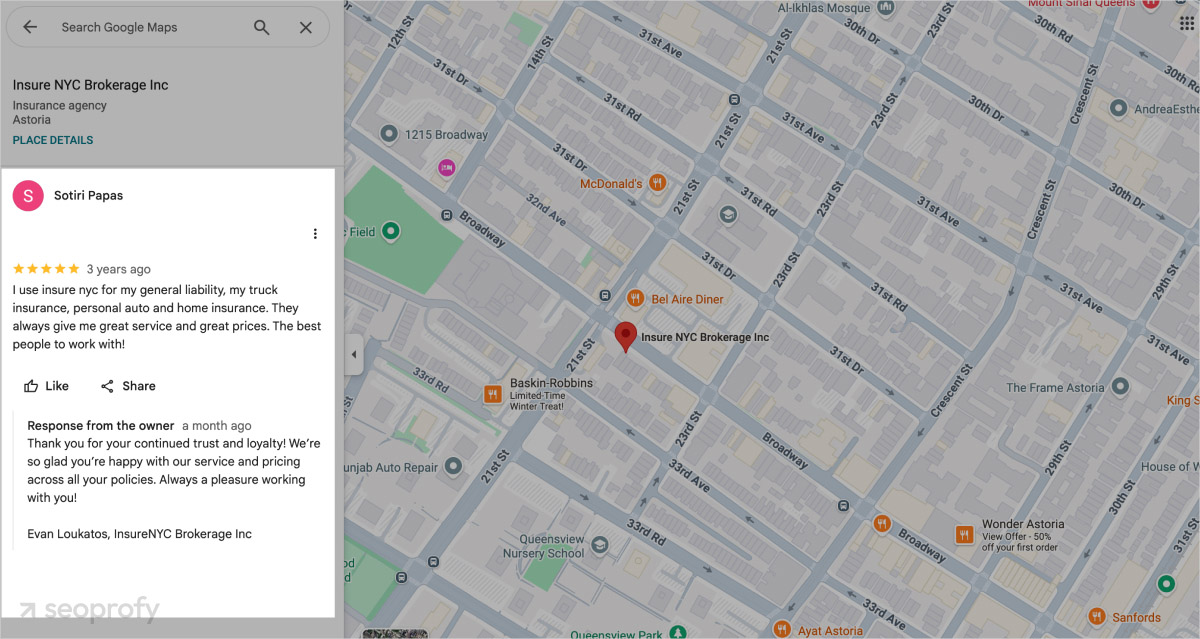

Turn Reviews Into a Ranking and Conversion Asset

Search engines evaluate review velocity, consistency, and topical relevance to determine local ranking and eligibility. Mentions of locations, business hours, and real scenarios help Google better match the company to high-intent queries.

Responses matter as well. They extend the entity’s semantic footprint and reinforce relevance signals over time. That’s why it shouldn’t be surprising that review management is one of the important SEO services.

From a conversion standpoint, reviews answer objections before contact. They reduce uncertainty and compress the decision window. That’s why teams need clear systems for review generation and internal guidelines for handling responses.

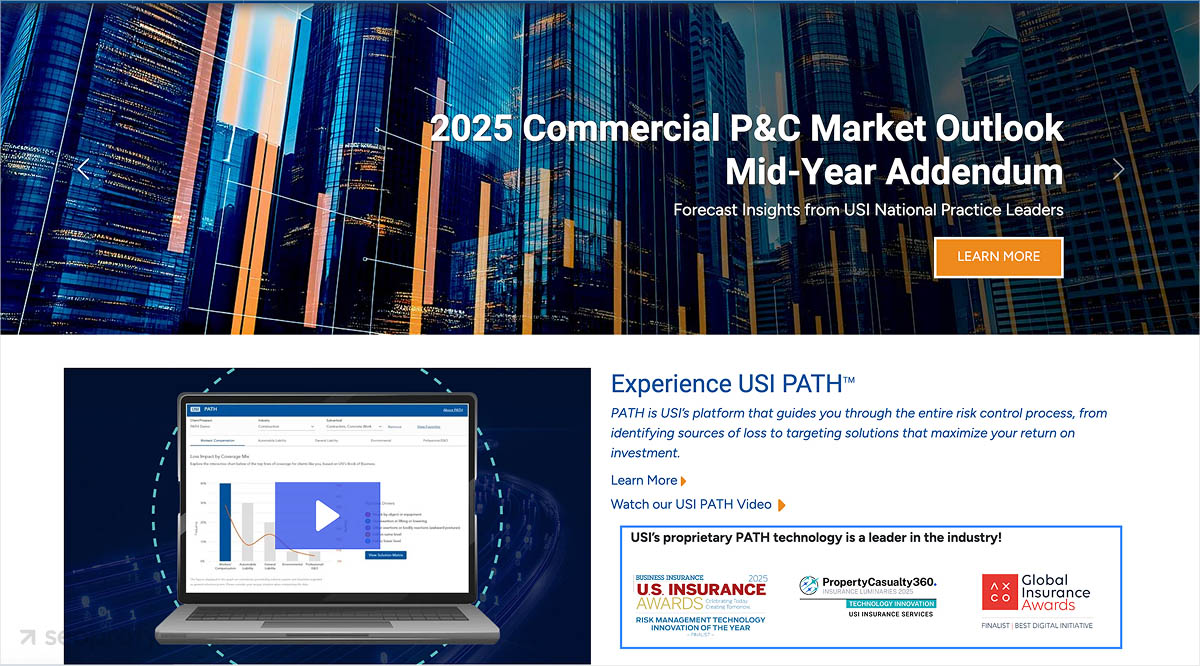

Strengthen Trust Signals and E-E-A-T

In SEO for insurance companies and agents, credibility must be explicit. Search engines and users both look for clear proof that the business is legitimate and qualified.

What actually strengthens trust:

- Licenses and compliance: Visible, up-to-date licences tied to jurisdictions you operate in.

- Named experts: Real people responsible for content, with roles and experience clearly stated.

- Case studies: Real examples showing how coverage, policies, or advice worked in practice.

Optimize for Mobile-First & “In-the-Moment” Searches

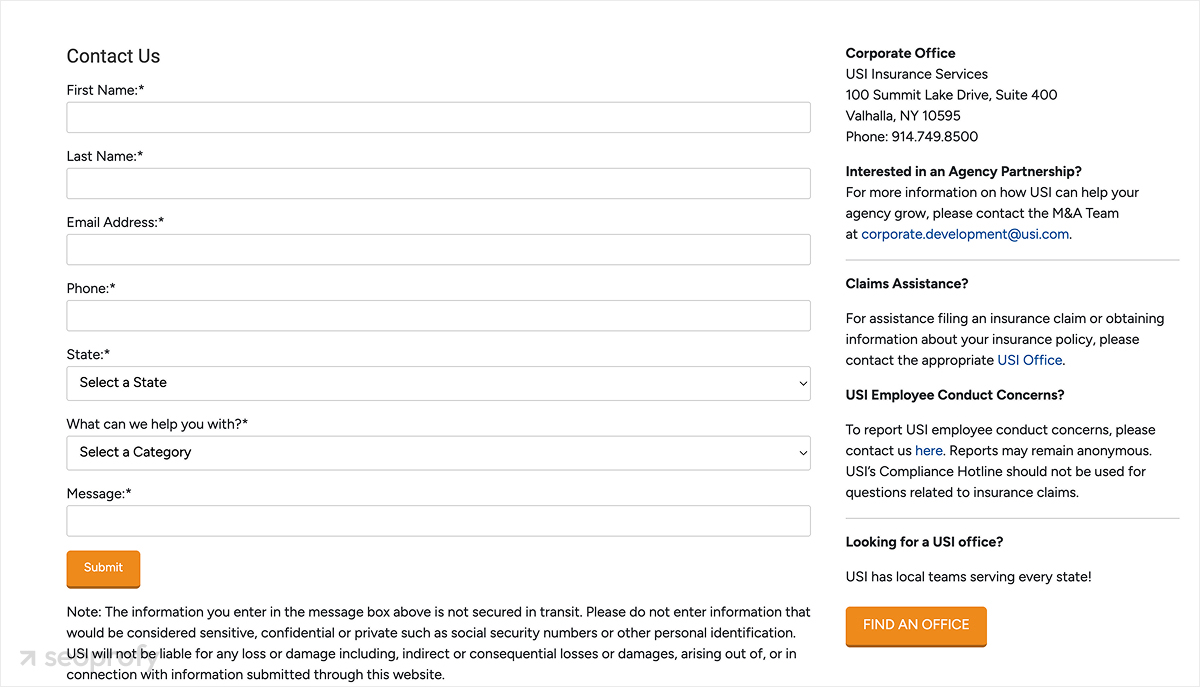

There are several strategies in SEO for insurance agency that help capture urgent insurance searches, which usually convert into high-intent leads. All of them can be summarised as “making the experience genuinely convenient for the user.” More specifically:

Mobile now accounts for over 62% of global web traffic, so insurance websites must be fast and easy to use on mobile devices. Load speed is also critical. When page load time exceeds one second, bounce rate can increase by up to 123%.

Navigation has to be clear and predictable, with CTAs that are easy to find and tested for real-world user behaviour. All paths should lead to simple, low-friction forms that avoid unnecessary questions and allow users to understand the offer and submit a request quickly, without hesitation or confusion. Here’s a good example:

All of these steps also directly support CRO and help maximize lead value as part of your overall SEO efforts. This technique works because SEO for insurance agencies increases the number of visitors, while CRO determines how many of them turn into quality leads.

Focus on Long-Term Visibility, Not Short-Term Hacks

SEO for insurance agents often shows early movement within 4–6 months, but compounding results usually come after a year of active work. It’s a long-term channel, but a highly profitable one. Search engine optimization delivers an 8× ROI, which is roughly double the average 4× return of PPC. That payoff doesn’t come with shortcuts. Short-term hacks are temporary and often create risk that surfaces later.

What actually works long term:

- Quality content is created and regularly updated to match demand.

- Trust-building through off-page SEO signals: earned links and credible references.

- Ongoing optimization across technical, content, and structural aspects.

- Result tracking with adjustments based on real SEO performance data.

Measure SEO Success by Leads and Revenue

After working with dozens of projects, the SeoProfy team has seen this clearly: for insurance brokers, search engine rankings and traffic are secondary. What really matters is whether organic search generates qualified leads, how much those leads cost, and how they convert into revenue. This is how SEO ROI should be evaluated in practice:

- Organic leads in Google Analytics 4, segmented by landing page and service

- Conversion rates for key pages and forms in GA4

- Cost per lead by comparing insurance search engine optimization spend with CRM lead volume

- Revenue attribution through your CRM and call tracking tools

Make your brokerage visible at the exact moment businesses compare policies. Attract serious inquiries, shorten sales cycles, and build authority in one of the most competitive markets.

- High-intent searches

- Better lead quality

- Clear competitive position

Final Thoughts: How Insurance Brokers Can Win More Local Clients with SEO

SEO is a high-ROI channel for attracting qualified, local insurance leads. In this guide, we shared practical SEO tips for insurance agencies based on real experience working with insurance projects end-to-end. These approaches are built for how online search works today and will continue to drive results in 2026.

If you’re looking for an experienced team that delivers insurance SEO services with clear accountability and performance-driven outcomes, SeoProfy is ready to help. Shall we discuss your project?