Ask five different companies how they calculate marketing budgets, and you get five different logics. You shouldn’t rely solely on guesswork when calculating the expenses. Knowing the average marketing budget by industry will help you set a realistic starting point and avoid randomness.

Many factors shape this decision, including your company size, growth stage, business model and activity, current economic factors, etc. This guide covers the main calculation formulas of marketing expenses, breaks down marketing spend as a percentage of revenue by industry, and highlights the common mistakes of spend planning.

- Most businesses spend about 8% of their total revenue on marketing.

- B2C businesses typically invest significantly more in their marketing compared to B2B.

- The business growth stage matters more than industry averages when allocating your marketing budget.

- New companies often allocate 30% to 50% of the budget on digital advertising to build awareness.

- Marketing spend ranges from 14.35% in competitive sectors like Consumer Packaged Goods to as low as 1.00% in the infrastructure-led Energy / Utilities sector.

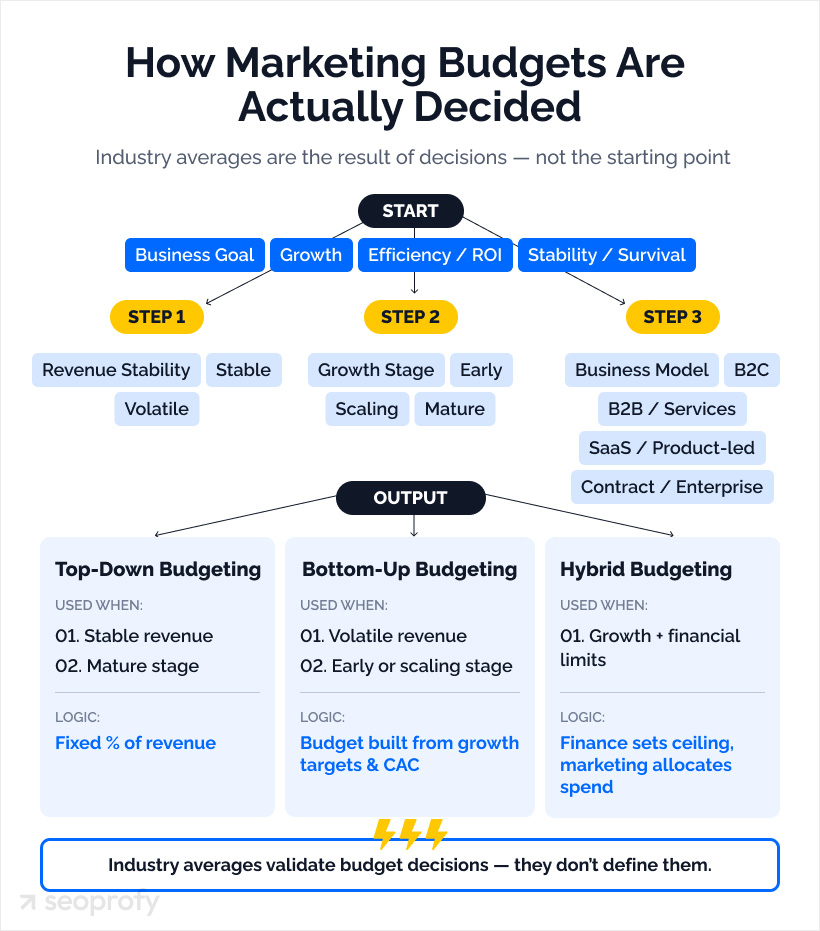

How Marketing Budgets Are Actually Set Inside Companies?

Setting a budget usually comes down to how a company approaches growth. Most businesses use one of three main ways to set their budget.

- Top-down budgeting. The CFO sets a limit based on total company revenue, and the team decides how to allocate marketing spend. Finance teams stick to this approach to keep spending predictable and aligned with what the company can afford. However, it disconnects marketing from real growth opportunities or emerging market trends.

- Bottom-up budgeting. In this case, the team estimates how much it will need to reach set business goals, based on customer acquisition cost (CAC), growth targets, and other KPIs. This aligns spending with marketing strategy and performance expectations, but it can exceed what the company can realistically afford.

- The hybrid model. A high-level spending limit is set by the finance team, and marketing evaluates what can be achieved within it. This approach balances strategic goals with financial predictability. It balances business goals and marketing efforts, but it can rely too heavily on internal assumptions, neglecting industry averages and missing what competitors are actually investing in.

Why “% of Revenue” Became the Industry Standard (and Its Limits)

Marketing spend as a percentage of revenue has become a default for a number of reasons. First, it is a logical, simple, and easy-to-communicate way to calculate it. It is usually clear how much you can invest. Second, this approach suggests that the marketing budget will grow as the business develops and generates revenue. Third, it protects the company from overspending and straining the budget.

According to the Gartner 2025 CMO Spend Survey, the average company invested about 7.7% of overall company revenue in marketing in 2025. This “rule of thumb” usually suggests staying between 7% and 10% for most small businesses, depending on growth stage and whether you’re B2B or B2C. B2C companies typically invest more.

However, the averages should be compared to your company’s growth stage and specific needs. Let’s review the cases when the approach of allocating a fixed percentage of revenue for the marketing budget works, and when it fails.

This approach works well for two types of companies:

- Mature businesses with steady sales: A fixed percentage supports the digital marketing to effectively reach specific goals.

- Predictable demand industries with long sales cycles: For example, Energy or Manufacturing, with average spend as low as 1.00% and 2.46% of revenue, respectively.

However, this model of budget allocation often fails in the following three cases:

- Startups: Growth priorities are much higher for these businesses than current revenue levels. Their key focus areas are acquiring customers, building and scaling brand awareness, and achieving product-market fit.

- High-growth SaaS: These companies often meet explosive customer acquisition opportunities. A fixed share of current revenue will underfund growth and slow market capture. Quick scaling, supported by upfront investment in active marketing campaigns, can create long-term revenue for these businesses.

- New market entrants: They have no revenue to base a percentage on. Sticking to the industry averages will not be enough to create the “noise” you need to be noticed and remembered. New businesses should heavily invest in digital marketing and advertising.

While the percentage-of-revenue model works well for a stable business, it is often not enough for a company that has just entered the market or is actively growing.

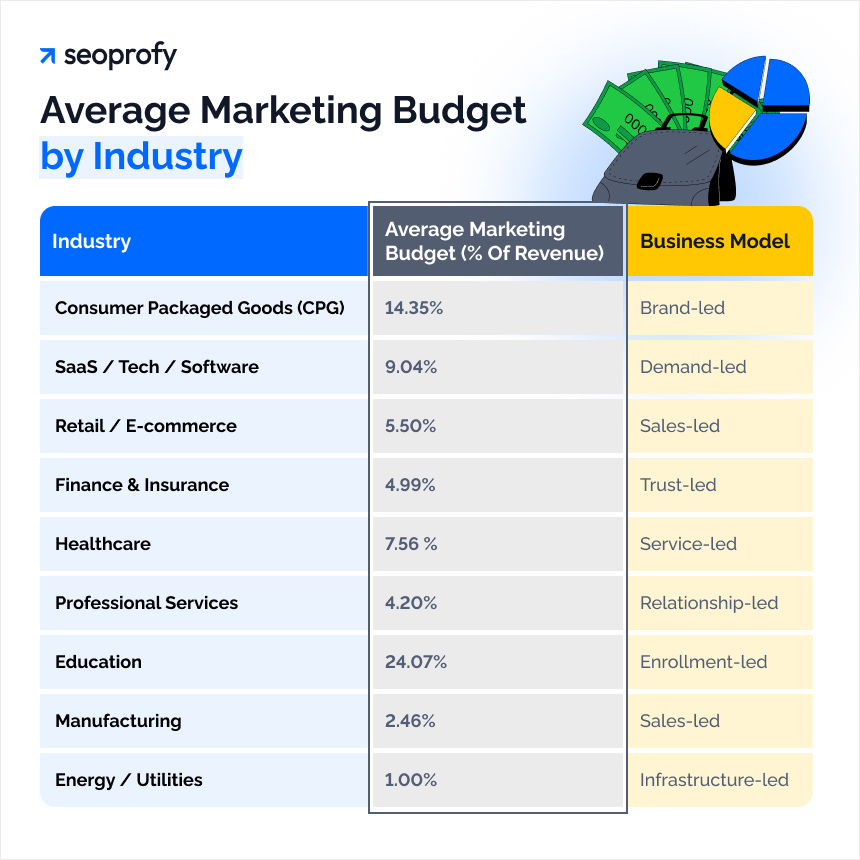

Average Marketing Budget by Industry

When you decide how much your marketing budget should be, industry benchmarks come in handy. But it is important to remember they just reflect what happens within the niche. It is not a rule you must follow to calculate your current marketing investments. Every company has a different reason for how much it spends.

We have analyzed recent reports on average marketing budgets by industry: Gartner CMO Spend Survey 2025 and The CMO Survey: Firm and Industry Breakout Report. Here are our observations.

|

Industry |

Average Marketing Budget (% of Revenue) |

Business Model |

| Consumer Packaged Goods (CPG) | 14.35% | Brand-led |

| SaaS / Tech / Software | 9.04% | Demand-led |

| Retail / E-commerce | 5.50% | Sales-led |

| Finance & Insurance | 4.99% | Trust-led |

| Healthcare | 7.56% | Service-led |

| Professional Services | 4.20% | Relationship-led |

| Education | 24.07% | Enrollment-led |

| Manufacturing | 2.46% | Sales-led |

| Energy / Utilities | 1.00% | Infrastructure-led |

Why do some sectors invest in marketing campaigns up to 24% while others spend as low as 1%? It is just the way different businesses grow or support their operations.

In Consumer Goods, you are fighting for the target customer’s attention every second, so the spending is much higher. If you aren’t running ads, your brand simply gets replaced by a competitor. But in sectors like Manufacturing or Utilities, things are different. You rely on long-term contracts and don’t need aggressive advertising to close a deal with a partner.

Your industry defines how much your company should spend on marketing. Whether you are building trust in Healthcare or acquiring users in Tech, your marketing costs are what allow you to compete.

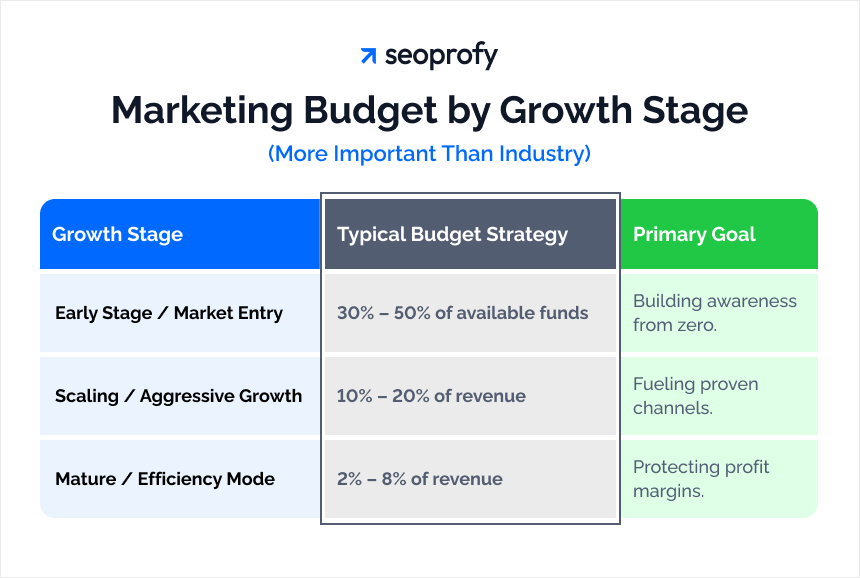

Marketing Budget by Growth Stage (More Important Than Industry)

Average marketing budget by industry is a helpful benchmark; there are other important factors to consider. One of them is your growth stage. A $10M SaaS company trying to take over a market behaves differently from a local law firm trying to keep its profits steady.

Let us take a look at how costs shift as businesses move through their lifecycle.

|

Growth Stage |

Typical Budget Strategy |

Primary Goal |

| Early Stage / Market Entry | 30% – 50% of available funds | Building awareness from zero. |

| Scaling / Aggressive Growth | 10% – 20% of revenue | Fueling proven channels. |

| Mature / Efficiency Mode | 2% – 8% of revenue | Protecting profit margins. |

If you only look at the average marketing budget by industry, you might not understand why your specific costs are different. The stage of your business changes the calculation significantly.

Early Stage

When you are just starting, you don’t have a brand people actively search for. You have to pay for many early interactions with your product. Startups are recommended to spend 30% to 50% of funds raised on marketing to create visibility, educate potential customers, and test marketing channels. They can exceed industry averages because spending a small percentage of low revenue wouldn’t generate enough isibility to survive and compete.

Scaling

Once the product sells well, companies refocus and invest in marketing channels that already bring results. Marketing costs here are tied to revenue and CAC. The key goal is to maximize growth efficiently without overspending. The percentage is commonly lower than in the early stage because the business already has traction and organic growth, but heavy marketing investment is still required to fuel rapid scaling.

Mature

Mature businesses often have stable revenue streams, established customer bases, and brand recognition. They can afford to spend less on marketing initiatives as a share of revenue because growth is slow but steady. Their focus shifts to optimizing ROI, maintaining market share, and protecting profit margins.

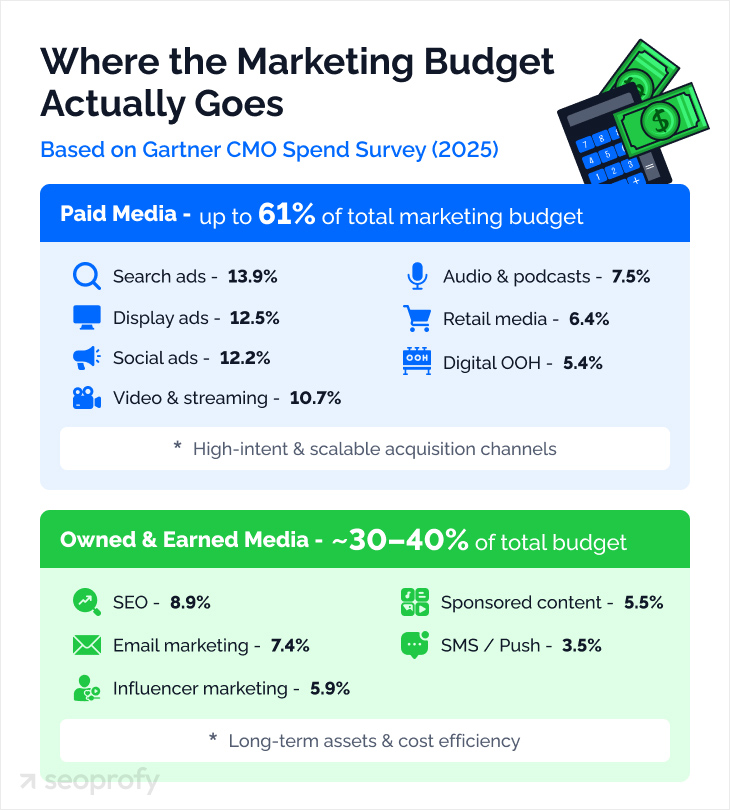

Where the Marketing Budget Actually Goes

Once you have settled on a number, the next question is where that marketing budget goes. The Garnter CMO Spend Survey shows that in 2025, paid media took up to 61% of total marketing budget across industries. The allocation looked in the following way:

Paid media:

- Search advertising – 13.9%

- Digital display advertising – 12.5%

- Social advertising – 12.2%

- Video and streaming – 10.7%

- Audio and podcast – 7.5%

- Retail media networks – 6.4%

- Digital OOH – 5.4%

Owned/earned media:

- SEO – 8.9%

- Email marketing – 7.4%

- Influencer marketing – 5.9%

- Sponsored content – 5.5%

- SMS/push notifications – 3.5%

Let’s review the five most important channels for every business:

SEO

Current B2B SEO statistics show that 88% of marketers plan to increase their budgets for SEO. This marketing channel brings organic traffic, builds credibility, and reduces reliance on paid ads, meaning future marketing budgets can shift from acquisition to retention or growth initiatives. Underinvesting is risky, as it slows growth and increases dependence on more expensive channels.

Content Marketing

High-quality articles, guides, and partner posts educate prospects and strengthen your brand authority. In the short term, they generate leads, improve conversion rates, and support marketing campaigns. Over time, they build authority, support SEO, and nurture target audiences. The result is a lower cost of acquiring customers in future marketing campaigns. Without content investment, brands risk slower growth and higher future marketing costs. Check our content marketing stats to see how this channel is measured and used by marketers.

Social Advertising

Ads on platforms like Facebook, Instagram, or LinkedIn (depending on your business model) help you reach the right audience quickly. They ensure immediate engagement, conversions, and gradually build brand recognition. Consistent investment in these marketing activities allows companies to reduce spending and improve targeting. Ignoring social advertising can limit reach and reduce the efficiency of future campaigns.

Search Advertising (Paid Search / PPC)

These ads are displayed across platforms when people actively look for your products or services. They can generate high-intent leads quickly and show measurable ROI. Data from paid search can be used to optimize targeting and ad creative, boosting overall marketing efficiency. Ignoring paid search may result in lost revenue and higher costs later.

Email Marketing

Email campaigns deliver targeted messages directly to your audience. In the short term, they ensure conversions, repeat purchases, and engagement with current leads. A strong email program builds customer loyalty and nurtures prospects, so a business may not need to rely as heavily on expensive paid campaigns. Underinvesting in email marketing can lead to lower retention, weaker customer relationships, and higher acquisition costs later.

Marketing Budget Allocation Checklist

Now that you understand what each of the channels means for your business, it is time to decide how to allocate the marketing budget. Here is a simple checklist:

- Align marketing results with your goals: Map each channel to a specific outcome: leads, conversions, retention, brand building, etc. Set a budget for each channel based on the specific KPI it needs to achieve, using your target metrics.

- Analyze ROI: Check how additional budget affects results. Is doubling the marketing costs producing meaningful extra conversions, or are gains flattening? Reallocate budget toward channels where extra investment moves the needle.

- Consider long-term impact: Marketing channels like SEO, content, and email grow over time, reducing future paid spend. Plan a budget within the next 6–12 months, not only for immediate returns.

- Adjust by growth stage: Early-stage businesses may invest heavily in brand awareness and acquisition to capture market share. Mature ones, on the other hand, prioritize efficiency and retention, funding channels that support steady growth.

- Track channel results across the funnel: Don’t look only at last-click conversions. Evaluate how channels assist long-term outcomes like awareness, nurturing, and retention. Adjust budgets where a channel drives long-term value, even if short-term ROI is modest.

The Most Common Marketing Budget Mistakes (Across Industries)

Now that you understand how budgets are calculated and which factors to consider, you must address a key question: what are the typical mistakes? Avoiding them will help you make the most of your marketing investment.

Blindly Following Competitors

They may have a higher LTV or lower operating costs. If you copy their spending without doing your own math, you risk losing money on every customer you acquire.

Budgeting Based on What Is Left

Many companies look at what is left after all other bills are paid and treat it as the marketing budget. However, it can be too small to get results even for a small business.

Prioritizing Short-Term Ads Over Brand Awareness

Performance marketing (like search ads) gives you instant results. But if you put 100% of your money there, you harm your brand. Without brand awareness, your digital advertising will get more expensive because nobody knows who you are.

Cutting SEO and Content First

When a business faces a necessity to reduce costs, the first thing many owners do is cut down on SEO or content creation because the results aren’t “instant.” This is a classic mistake. SEO builds value over time.

Reducing Marketing Spends in Economic Downtimes

This is the biggest mistake. Keeping your ads running when others stop sends a signal of stability to your target audience. It tells the market you are healthy and “holding it down” while others are struggling. When your rivals reduce their marketing spending, the cost of target customer attention goes down.

Key Takeaways — How to Use Industry Averages Correctly

Marketing budget industry averages are useful as a guide, but they should never replace your own thinking. Your growth stage often matters more than your market niche: new companies may need higher budgets to gain visibility. Budget allocation is more important than the percentage itself. Every decision should be tied to your metrics that clearly ensure your spending drives real business outcomes. Benchmarks are diagnostic tools, helping you identify opportunities and risks, but smart budgets are designed around your goals and market position, not copied from competitors.

Now is the time to audit your marketing spend and review the logic behind it. SeoProfy’s team of 100+ experts can help design data-driven strategies focused on sustainable growth and long-term assets like SEO.